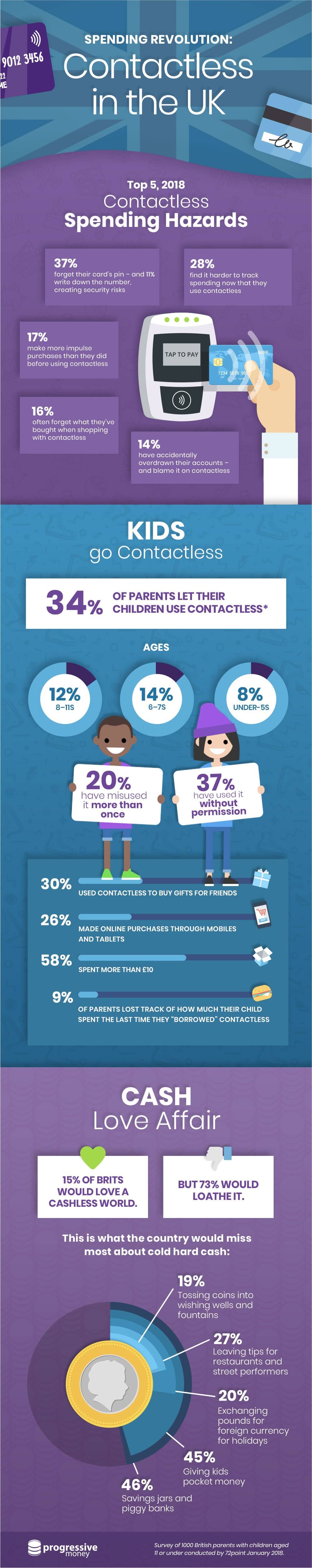

Contactless technology has vastly changed the way we spend. This convenient, simple way to make purchases was introduced a little over 10 years ago – and now, card use as a method of payment is at an all-time high.

As a nation, we’re now making more frequent, smaller card payments than ever before and according to our recent survey, in which we talked to 1,000 parents of under-11s, it’s while in the supermarkets that we’re most tempted to quite literally tap into our money. More than half (61%) told us they’re most likely to use contactless payments while doing their food shop, while – and here’s the real problem – nearly one in five (17%) admit to making more impulsive purchases thanks to the rise of contactless technology. It’s these one-off, little-thought-about purchases that all mount up, and at the end of the month, we’re left wondering where all our money has gone.

So how can we keep an eye on our spending and manage our finances as we hurtle further towards a much-discussed paperless and cashless society? We take a look at some top tips for how you can keep a handle on your finances in this world of so-called frictionless spending.

Bring back the weekly food shop

A simple one, but doing this could help you break down your grocery budget into more manageable chunks and leave you with a better idea of where you stand week in, week out. At the beginning of every month, divide your budget into the number of weeks in the month, and visit the supermarket weekly – and take cash to pay at the checkout. You’re less likely to go into the supermarket throughout the week, and as a result, less likely to spend without thinking.

Carry cash on your person

Of course, you don’t want to make yourself a vulnerable target with a huge wad in your back pocket, but do try to carry small amounts of cash where possible and use this as your ‘pot’ for the next couple of days. Nearly one in five (18%) people don’t carry enough cash on them to make planned purchases, so they rely on contactless – but this only serves to make them more prone to overspending.

Budget for the week

Have a think about what you’re likely to spend over the coming week – then create a budget and stick to it. More than a quarter (28%) of people we spoke to admitted that since using contactless payment methods, they find it much harder to keep track of their spending, while one in 10 (9%) even said they don’t recognise all the charges on their bank statement at the end of the month.

Track your spending

Be it via an app, on your phone’s notepad or simply using a good-old fashioned handwritten list, you can keep abreast of all your outgoings. Thanks to the ease of contactless payments, one in six (16%) people routinely completely forget what they’ve spent on. By listing out all your purchases, you’ll have a much clearer idea of what you’ve spent each month – and how much you have left.

Consider need vs want

We’ve all been there a thousand times: you’re queuing to pay for the essentials and reach the counter, only to be faced with a deluge of tempting offers. You give in because, well, it’s only a quick tap of the card and you’ll not really notice that extra couple of quid. But it’s all these little impulse buys that really add up at the end of the month. Get into the habit of taking a step back and asking yourself whether you really need the item that’s taken your fancy. If not, put it back. You might be surprised at how making better decisions like this will amount to quite a bit extra sitting in your account at the end of the month.

Set a goal

Instil some motivation in yourself by setting a savings goal, whether long-term or short-term. Maybe you’d like to put a deposit down on a house in the near future, or you’re planning to jet off to sunnier climes for your annual holiday? Having your goal at the forefront of your mind will mean you’re more likely to succeed in saving money, or perhaps put more accurately, not impulsively spend on contactless.

Of course, contactless technology makes our lives that little bit easier by enabling quicker, fuss-free payments on purchases. But taking the time to better manage our spending and keeping tabs on those smaller payments is the answer to a healthier bank balance and keeping control of our finances.

Be sure to find out how to manage contactless spending and how to introduce children to contactless shopping with Progressive Money.

Survey of 1000 British parents (with children aged 2 – 11) who use contactless technology provided by 72point in January 2018.

*Of these participants, 34% report that their children do/have used contactless technology. The percentage shown represents the number of responses received.

It’s a monumental time for retail – so monumental in fact, that many are debating whether we’re now starting to see the beginning of the end for cash and physical payments.

In July last year, it was announced that for the first time, the volume of retail purchases made by card accounted for more than half of all customer transactions. It’s little wonder when contactless payment is so simple – effortless even. In fact, contactless transactions now make up around a third of all card purchases.

But it begs the question of whether it’s become too easy to spend money, and in doing so, are we unintentionally passing on bad habits to our children – especially if you take into consideration the results of our survey. We found that more than a third (34%) of parents say their primary and pre-school-aged children have used contactless technology to spend money at some point.

The future of spending

To children, the idea of budgeting is often already an alien concept and if they’re spending money using contactless technology there’s every chance they won’t even consider it ‘real money’. Children of this age are only just being introduced to the world of money and need to be taught about responsible spending. But are we letting standards slip? We surveyed 1,000 contactless-using parents of two-to-eleven year olds, and one in three (34%) told us that their children are also using payment contactless technology. Of these parents, more than a third (37%) admitted their children had used their contactless cards without permission. Further to this, one in five (20%) said that their kids had spent more than they had agreed to the last time they misused a contactless card.

So what do we really need to focus on when it comes to teaching our little ones the value of money in a contactless world? We take a look at the main lessons that will help your children understand money basics.

Contactless is real money

Children learning about money will naturally associate it with coins and notes, so they can’t be expected to fully understand if it’s not a physical entity placed in front of them. Explain to them that there are many ways in which you can pay for things now and physically handing over cash is just one of them. Let them know that contactless spending has repercussions – money is still exchanging hands behind the scenes and the amount you have to spend still goes down.

The importance of permission

Of the parents we surveyed whose children had used their contactless technology without their knowledge, more than half (56%) spent an amount of up to £20 – a relatively large sum if you’re not expecting it to disappear from your account. Explain to your child that using somebody else’s card and money without their permission isn’t acceptable (or legal!) and set and agree boundaries which they can understand. Doing this helps build good money-management skills which your kids can start thinking about now, and long into the future.

The danger of in-app purchases

You might have heard various news stories about kids spending frivolously on in-app purchases, their parents left with little choice but to foot the bill. It’s a very real problem and one that can’t be wished away by parents protesting that they didn’t consent to their child racking up such a hefty amount. Various games on the market include a number of additional items and collectables or a promise to unlock content – but it all comes with a price tag. A couple of years ago, Apple found itself at the center of a deal with the Federal Trade Commission to pay $32.5m to parents whose children made in-app purchases without permission. While it’s been argued back and forth over who should ultimately be held responsible for children spending their parents’ money to keep up with the app, there are things you can do to safeguard bank account. If your child uses your device and they’re old enough to understand, explain a little about the danger of in-app purchases and that they still cost money in the real world. You should also make sure you’re on top of your device’s in-app purchases restrictions and don’t give your children your app store password.

The budget

In today’s age of contactless spending, it’s easier than ever to overspend and completely lose track of what’s going out of your account. No longer is there a need to hand over hard currency – and even the physical interaction with the chip and pin machine is now on the decline. When it comes to yours and your children’s spending, the key is visibility and budgeting. More than a quarter (28%) of parents we spoke to admitted it’s harder to keep track of their spending now they’re using contactless. Be sure to budget at the beginning of every month and keep a keen eye on everything going out of your bank account.

Digital pocket money for kids

Teach your children about contactless spending using real-life methods – and there are a number of apps and initiatives that enable you to do this. For example, you can set up regular pocket money transfers or make one-off payments to your children, or set them activities to encourage them to learn even more. Contactless for kids is the latest must-have banking tool for families and allows for complete control over your children’s spending – all the while allowing them a little freedom and helping them get a better understanding of how money works.

Taking some time to properly explain to your children about money and breaking down the basics of spending in a contactless world can protect your finances and set them up with skills for life.

Contactless tech has revolutionised how we spend money. From creating new spending hazards, to influencing our relationship with cash, here are the latest facts and spending trends emerging this year.

Be sure to find out how to manage contactless spending and how to introduce children to contactless shopping with Progressive Money.

Survey of 1000 British parents (with children aged 2 – 11) who use contactless technology provided by 72point in January 2018.

*Of these participants, 34% report that their children do/have used contactless technology. The percentage shown represents the number of responses received.

Pancake Day or Shrove Tuesday is on 13th February in 2018. It is celebrated in the UK, Ireland and parts of the Commonwealth

Always preceding Ash Wednesday, Pancake Day falls 47 days before Easter There are lots of events around the country where people take to the streets to participate in pancake races. The Shrove Tuesday pancake race at Olney, Buckinghamshire has been run since 1445.

In other countries, the day is celebrated with a carnival and is referred to as Mardi Gras, or ‘Fat Tuesday’, the last night of eating fatty foods before the fasting period of Lent begins.

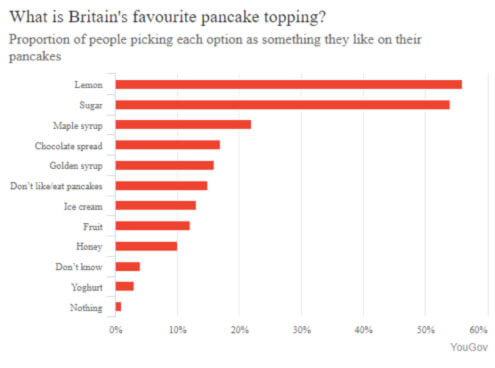

What’s the UK’s Favourite Topping?

Forget chocolate or maple syrup, Britain’s favourite pancake topping is lemon according to a poll by YouGov.

In an online survey of more than 5,000 British adults, 56 per cent of respondents said that they liked to have the citrus fruit on their pancakes, making it the nation’s topping of choice.

- Sugar came a close second with 54 per cent of respondents putting it down as a something they like to have.

- Maple syrup came in a distant third on 22 per cent while chocolate spread could only manage fourth choice on 17 per cent.

- Just 12 per cent of Britons like to put fruit on their pancakes while one in 100 people said they liked to have their pancakes plain and 15 per cent of people don’t like pancakes at all.

- Young people were far more likely to put chocolate or fruit on their pancakes.

The History of Pancake day

- The word ‘shrove’ is the past tense of ‘shrive’, meaning to hear confession, impose a penance or give absolution. Shrove-tide was a week of confession and merriment before Lent.

- It is said to have started when a woman ran to church still holding a pan when her cooking was interrupted by the church’s shriving bell.

- Shakespeare uses the simile “as fit as a pancake for Shrove Tuesday” in All’s Well That Ends Well.

- The sales of Tate & Lyle golden syrup triple in the week of Shrove Tuesday.

Pancakes Facts

- Some well-known expressions are “as flat as a pancake” was first recorded in 1761 though “as flat down as pancakes” dates back at least to 1611.

- The world record for pancake eating is fifty 3.25oz pancakes in ten minutes.

- The world’s largest pancake was made in Rochdale, Greater Manchester in 1994. the pancake measured 15.01 m (49 ft 3 in) in diameter and 2.5 cm (1 in) deep, it was a whopping 49 feet 3 inches in diameter.

- Australian chef Brad Jolly set a record in 2012 by tossing a pancake 140 times in a minute.

- On 8th February 2005 in London Chef Aldo Zilli broke the world record for the highest pancake toss at 329 cm.

Source:

www.historic-uk.com/CultureUK/Pancake-Day/ by Ellen Castelow: http://www.dailymail.co.uk/news/article-5307643/When-Pancake-Day-Shrove-Tuesday.html

www.telegraph.co.uk/news/2017/02/28/pancake-day-britains-favourite-pancake-toppings-revealed/

guinnessworldrecords.com/world-records/68403-largest-pancake

Progressive Money, a unsecured loans provider based in Manchester, has been featured on the Sunday Times Virgin Fast Track 100 league table for the second year in a row.

Published every December, the research highlights those British Companies who have achieved the fastest-growing sales within the last three years. Featured for a second time Progressive Money, as part of the Darwin Group, successfully claimed the 82nd spot as their annual sales increased by more than 52% throughout this period.

Lynne Hardwick – Head of Marketing at Progressive Money – was delighted by the news:

“This is a fantastic achievement and we are extremely proud of all out staff and their continuing efforts. We clearly couldn’t so it without their hard work and support.”

“When you consider how many thousands of private businesses there are, appearing anywhere in the top 100 is very special. We are delighted to appear once again in the Sunday Times Virgin FastTrack 100.”

The league table is compiled by Fast Track and published in the Sunday Times every year. To qualify, firms must meet a variety of conditions. For example, they must be registered in the UK and have variable sales growth throughout the three-year-period. Of those included in the list, two others were from Manchester Missguided and CarFinance247.

Based on Portland Street, Progressive Money is part of Darwin Loan Solutions, and alongside it’s sister company Evolution Money, employs more than 140 staff members. The firm hopes to continue to growing and make it third time in a row during 2018.

As December diaries fill up with Christmas shopping, family visits and the all-important Boxing Day sales, New Year’s Eve is rarely overlooked. A highlight of the social calendar, it’s a chance to see our nearest and dearest and raise a glass to what’s ahead. For the more adventurous travelling types who want to take in more than the traditional firework display this New Year’s Eve, we can point you in the right direction.

We’ve compiled a guide to five European cities that breaks down the cost of a visit to each. It includes everything from the cost of a pint in Paris to a bed in Berlin, so you can decide where to get the best value-for-money trip. So read on if you fancy splashing out on a New Year mini-break to remember.

Amsterdam

With canal-side walks and culture spilling from every gallery and museum, Amsterdam is well worth spending more than a day in. But if you’re heading there for New Year, there’s also plenty of festive fun on the menu. With a three-course meal and club night at Old & New 2017, or a casual-chic cruise off Ruyterkade pier 14, you can choose your own Amsterdam adventure. Hotels hover around the £150 mark for New Year’s Eve, making Amsterdam’s hotel rooms the most expensive of the five from our research. That’s no reason to miss out on what promises to be a great evening taking in the sights, though.

Total per person: £440.60

Barcelona

Barcelona always brings its A-game for visitors keen to soak up some culture, but when it comes to New Year’s Eve, it takes things up another notch. The NYE party at Poble Espanyol draws you into the beautiful surroundings of the open-air architectural museum, with the soundtrack of Europe’s top DJs. Alternatively, check out the club night at Pacha, playing music that will get you hyped for the midnight countdown and chill you out afterwards. After Amsterdam, Barcelona is putting on the most affordable events, averaging out at around £50 per person. It’s a great way to ring in the New Year with some stunning scenery.

Total per person: £408.41

Berlin

Divided by the Wall for so long, Berlin has grown faster than most European destinations in recent years and now offers a diverse range of entertainment – so you know there’s plenty to do for the New Year. For under £400 a head, you can sample the creative atmosphere for yourself – the lowest overall total in our guide. Hotels are the second cheapest on our list, and the cost of a good meal is very affordable too. For your New Year celebration, choose between an 8-in-1 ticket to Berlin’s hottest clubs, or enjoy an evening’s dinner and dancing in a beautiful palace ballroom overlooking Lake Tegel.

Total per person: £396.11

Paris

Whether you’re on the steps of Sacré-Coeur or mingling with the crowd along the Champs-Élysées, there’s a special New Year buzz in the Parisian night air. Before that, choose between a cruise on the scenic Seine with dinner and dancing, or a meal at the world-famous Le Duplex nightclub featuring violinists in concert. Either way, you can still ring in the New Year beneath the towering l’Arc de Triomphe. Paris hotels average a little over £50 per night, the cheapest on our list by far, so you can be sure of an affordable New Year getaway if you choose to spend it in the French capital.

Total per person: £400.30

Prague

At a shade over £500 per person, it may be the most expensive way to spend the New Year in our guide, but this Bohemian beauty at its dazzling best is one not to be missed. It’s the cheapest on our list in terms of food and drink, so check out what’s on offer at the fusion restaurants and rooftop bars throughout the city. If you’re keen to celebrate New Year’s Eve in style, book tickets for a scenic river cruise featuring a smooth jazz act. Enjoy a few glasses of fizz on the top deck when the fireworks go off at midnight.

Total per person: £502.59

If you’re looking to try something different for the New Year, it’s a great chance to see a new side to your favourite European city. So why not take the plunge and see how Europe steps up its game when it comes to celebrating?

Prices correct at time of research, November 2017.

Your Big Day

Military style planning of your wedding, and your wedding budget, is vital when it comes to staying in control of costs. The worst-case scenario is that you can quickly find yourself in over-your-head. You could end up very embarrassed if you end up having to change the plans you’ve shouted from the rooftops.

In the first instance, keep your wedding plans to yourself. At least until your major bookings are confirmed and you’re ready to post out your invitations. That way, if you decide 100 people is far too expensive to cater for, or if bank of Mum and Dad don’t deliver the contribution you were expecting, you can still tweak your plans before it’s too late.

The more you start researching your wedding, the more fabulous things you will find. Your heart will tell you that you simply need them, but your head must tell you otherwise! Everything costs money, so start a spreadsheet. Enter absolutely everything and keep a close eye on your costs. If the photo-booth must go so you can afford the flowers you want, so be it. You need to get your head around the fact you can’t have everything!

Don’t forget those unexpected costs. Everybody always over invites guests knowing that not everybody will be able to make it on your big day. Make sure you are covered in case everybody can!

Wedding Day Tips

Let’s look at some top tips to ensure that your wedding budget stays on track.

Number 1

Decide on your guest list. You need this before you can choose your venue. (Venue too big and guest list too small equals no atmosphere. Venue too small and guest list too big equals a disaster!). Plus, how you can even begin to set a budget if you don’t know how many people are going to be there. Once you have this, you are armed with numbers for visiting wedding venues and gaining quotes.

Number 2

Have more than one option. Lots of people would love to be married in St Paul’s Cathedral, followed by a reception at Buckingham Palace. It’s unlikely to happen, unless your blood runs exceptionally blue. Your first-choice venue may not be available until 2027, or might cost more than you’d expected or budgeted for. If you have a selection to visit, do it. It’s surprising what you will find if you open your mind. Maybe that place that wasn’t so high up on your list is actually gorgeous and the perfect size and cost for your wedding day.

Number 3

Once you’ve decided on your venue, build a relationship with the staff. You are going to need these people to ensure that your wedding day is hitch free. Establish a solid working relationship with your wedding team. They will then be in your corner – that’s half of the job already done!

Number 4

More often than not, the largest expense for your wedding reception is going to be the food and drink. Look at a wide choice of menus and secure the costs as early as you can so you can set the money aside in your budget. Drinks packages can cost an absolute fortune. As soon as venues hear the word ‘wedding’, the prices have a tendency to sky rocket. Think about it carefully – your friends and family don’t want you to bankrupt yourselves. At the end of the day, can many people really tell the difference between Champagne and Cava? It will dramatically reduce your costs.

Get creative! Would hiring a fish and chip van for the evening be a quirky touch and less expensive than a buffet for your evening guests?

Number 5

This is where you can really make some savings. Make smart decisions when you hire all the other services. This could be the photography, cake, music, flowers and décor that you choose. A live band can be considerably more to hire than a DJ in most cases. Photographers vary a lot, it can be a good move to find somebody just setting out in the business, trying to make a name for themselves, and ask yourself, ‘Could you live without those seat covers and will anybody really notice?’

You’ve fixed your main expenses now. Price everything else up and give yourself a pick n mix list. Move it around and play with it. Maybe it’s worth having your second-choice flowers if it means you can put balloons on all the tables?

There’s no need to rush and panic. Taking your time might also make you think twice about adding the Swarovski crystal table decorations or the firework display at Midnight. Put it on your spreadsheet and then take the time to reflect. Don’t make knee-jerk decisions.

And Finally

Always remember that everything is flexible and can be moved around. Cut costs in one area and add them into other. After all it is your wedding day.

We’ve teamed up with our friends over at Evolution Money to produce this wedding day info graphic. We hope it helps

https://www.evolutionmoney.co.uk/infographics/controlling-your-wedding-costs

If you’re looking to raise funds for your dream day then Progressive Money could be able to help. We’ve been arranging personal loans for weddings for years. We even know that in the town of Haverfordwest, 11% of all our loan requests are to fund weddings!

Whatever route you go down, enjoy yourselves and have the time of your lives.

Manchester Call Centre

Manchester Call Centre