It’s a monumental time for retail – so monumental in fact, that many are debating whether we’re now starting to see the beginning of the end for cash and physical payments.

In July last year, it was announced that for the first time, the volume of retail purchases made by card accounted for more than half of all customer transactions. It’s little wonder when contactless payment is so simple – effortless even. In fact, contactless transactions now make up around a third of all card purchases.

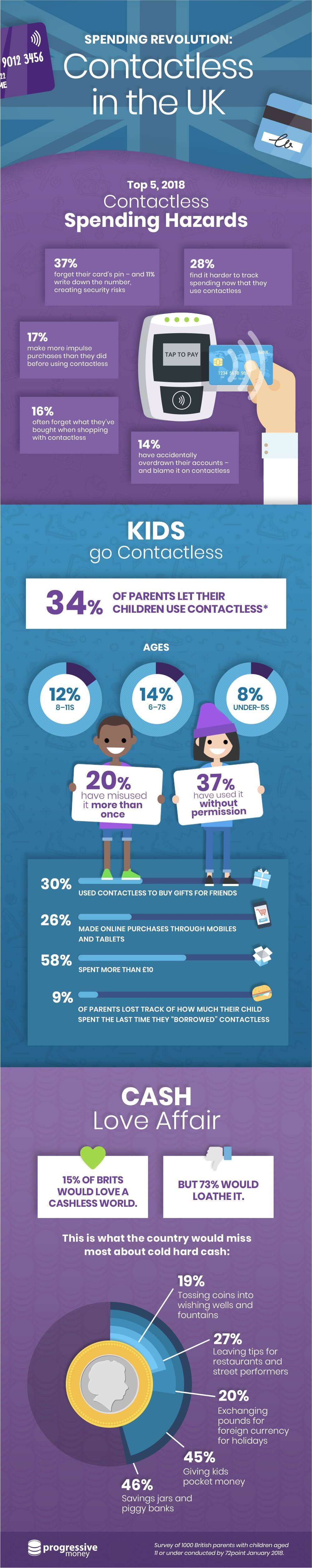

But it begs the question of whether it’s become too easy to spend money, and in doing so, are we unintentionally passing on bad habits to our children – especially if you take into consideration the results of our survey. We found that more than a third (34%) of parents say their primary and pre-school-aged children have used contactless technology to spend money at some point.

The future of spending

To children, the idea of budgeting is often already an alien concept and if they’re spending money using contactless technology there’s every chance they won’t even consider it ‘real money’. Children of this age are only just being introduced to the world of money and need to be taught about responsible spending. But are we letting standards slip? We surveyed 1,000 contactless-using parents of two-to-eleven year olds, and one in three (34%) told us that their children are also using payment contactless technology. Of these parents, more than a third (37%) admitted their children had used their contactless cards without permission. Further to this, one in five (20%) said that their kids had spent more than they had agreed to the last time they misused a contactless card.

So what do we really need to focus on when it comes to teaching our little ones the value of money in a contactless world? We take a look at the main lessons that will help your children understand money basics.

Contactless is real money

Children learning about money will naturally associate it with coins and notes, so they can’t be expected to fully understand if it’s not a physical entity placed in front of them. Explain to them that there are many ways in which you can pay for things now and physically handing over cash is just one of them. Let them know that contactless spending has repercussions – money is still exchanging hands behind the scenes and the amount you have to spend still goes down.

The importance of permission

Of the parents we surveyed whose children had used their contactless technology without their knowledge, more than half (56%) spent an amount of up to £20 – a relatively large sum if you’re not expecting it to disappear from your account. Explain to your child that using somebody else’s card and money without their permission isn’t acceptable (or legal!) and set and agree boundaries which they can understand. Doing this helps build good money-management skills which your kids can start thinking about now, and long into the future.

The danger of in-app purchases

You might have heard various news stories about kids spending frivolously on in-app purchases, their parents left with little choice but to foot the bill. It’s a very real problem and one that can’t be wished away by parents protesting that they didn’t consent to their child racking up such a hefty amount. Various games on the market include a number of additional items and collectables or a promise to unlock content – but it all comes with a price tag. A couple of years ago, Apple found itself at the center of a deal with the Federal Trade Commission to pay $32.5m to parents whose children made in-app purchases without permission. While it’s been argued back and forth over who should ultimately be held responsible for children spending their parents’ money to keep up with the app, there are things you can do to safeguard bank account. If your child uses your device and they’re old enough to understand, explain a little about the danger of in-app purchases and that they still cost money in the real world. You should also make sure you’re on top of your device’s in-app purchases restrictions and don’t give your children your app store password.

The budget

In today’s age of contactless spending, it’s easier than ever to overspend and completely lose track of what’s going out of your account. No longer is there a need to hand over hard currency – and even the physical interaction with the chip and pin machine is now on the decline. When it comes to yours and your children’s spending, the key is visibility and budgeting. More than a quarter (28%) of parents we spoke to admitted it’s harder to keep track of their spending now they’re using contactless. Be sure to budget at the beginning of every month and keep a keen eye on everything going out of your bank account.

Digital pocket money for kids

Teach your children about contactless spending using real-life methods – and there are a number of apps and initiatives that enable you to do this. For example, you can set up regular pocket money transfers or make one-off payments to your children, or set them activities to encourage them to learn even more. Contactless for kids is the latest must-have banking tool for families and allows for complete control over your children’s spending – all the while allowing them a little freedom and helping them get a better understanding of how money works.

Taking some time to properly explain to your children about money and breaking down the basics of spending in a contactless world can protect your finances and set them up with skills for life.

Contactless tech has revolutionised how we spend money. From creating new spending hazards, to influencing our relationship with cash, here are the latest facts and spending trends emerging this year.

Be sure to find out how to manage contactless spending and how to introduce children to contactless shopping with Progressive Money.

Survey of 1000 British parents (with children aged 2 – 11) who use contactless technology provided by 72point in January 2018.

*Of these participants, 34% report that their children do/have used contactless technology. The percentage shown represents the number of responses received.

Manchester Call Centre

Manchester Call Centre