It’s the start of a new year and that means it’s a great time to take a fresh look at your finances. If you’ve resolved to be more savvy with your money in 2018 now is the time to get saving.

The first step to saving money

is to take a cold hard look at your incomings and outgoings to make cuts (it often starts with shop-bought lunches) and plan a budget.

Over half of UK households keep a regular budget. Most say it gives them peace of mind about how much they are spending and makes them feel better about life in general.

To get started on your budget, you’ll need to work out how much you spend on:

- Household bills

- Living costs

- Financial products (insurance…)

- Family and friends (presents…)

- Travel (car costs, public transport…)

- Leisure (holidays, sport, restaurants…)

Keep a Track on your spending

If you’re spending more than you have coming in, you need to work out where you can cut back.

This could be as easy as making your lunch at home, or cancelling a gym membership you don’t use.

You could also keep a spending diary and keep a note of everything you buy in a month.

Or, if you do most of your spending with a bank card, look at last month’s bank statement and work out where your money is going.

Alternatively, you can set up a budget using a spreadsheet or just write it all down on paper.

Free Apps available

There are also some great free budgeting apps available and your bank or building society might have an online budgeting tool that takes information directly from your transactions

Haggle on household bills

Haggling might sound daunting but Which? research shows you can save around £725 a year just by questioning the price of your household bills. In October 2017, Which? surveyed more than 2,000 people about their haggling experiences and 58% said they had negotiated sizeable discount. There are also savings to be made on car insurance, home insurance, car breakdown cover, mobile, broadband & pay TV and energy bills.

Automate your savings

It’s easy to use all the extra money you free up in your budget on extra treats rather than saving it. But there are more and more ways to get into the savings habit without actually doing much. There are a few free automated savings app that monitors your spending habits, works out what you can afford to save and siphons what you can spare out of your account. So why not check with your bank to see if they have this app facility available.

Get into the cashback habit

If you shop online, you should try to get into the habit of using cashback websites to save every time you make a purchase. When you shop using the many cashback websites available, you can earn a percentage (typically 1%-15%) of what you spend back. Quidco estimates members earn £305 back each year while Top Cashback claims members amass a whopping £356 per year with this simple shopping trick.

Join more loyalty schemes

Loyalty schemes that are free to join are a great way to rack up savings as you spend. Most of us will have supermarket loyalty cards like the Tesco Clubcard or the M&S Sparks card but there are lots more schemes you might not have heard of that can help you build up points that turn into vouchers or give you access to freebies. Asos A-List, The Body Shop Love Your Body, the Nando’s Card, my John Lewis, IKEA Family and Boots Advantage these are just some of the loyalty cards available.

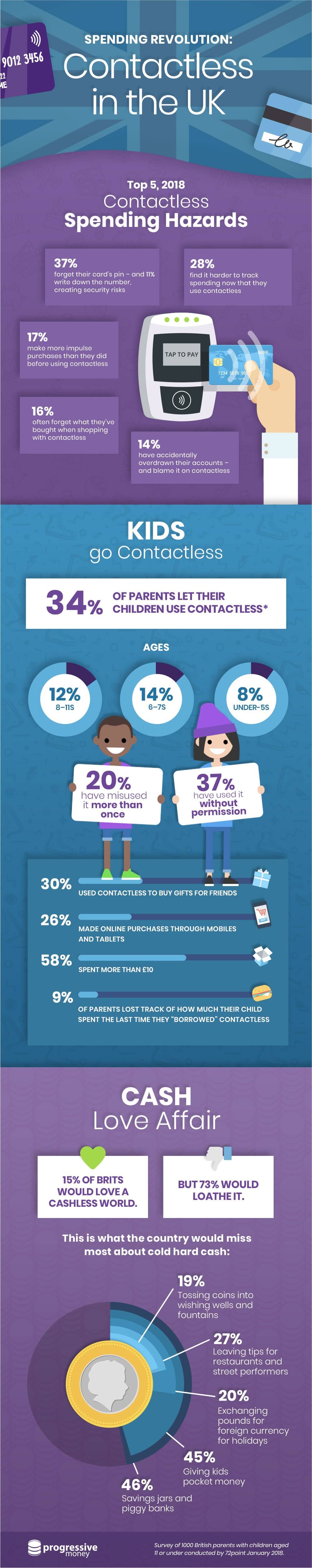

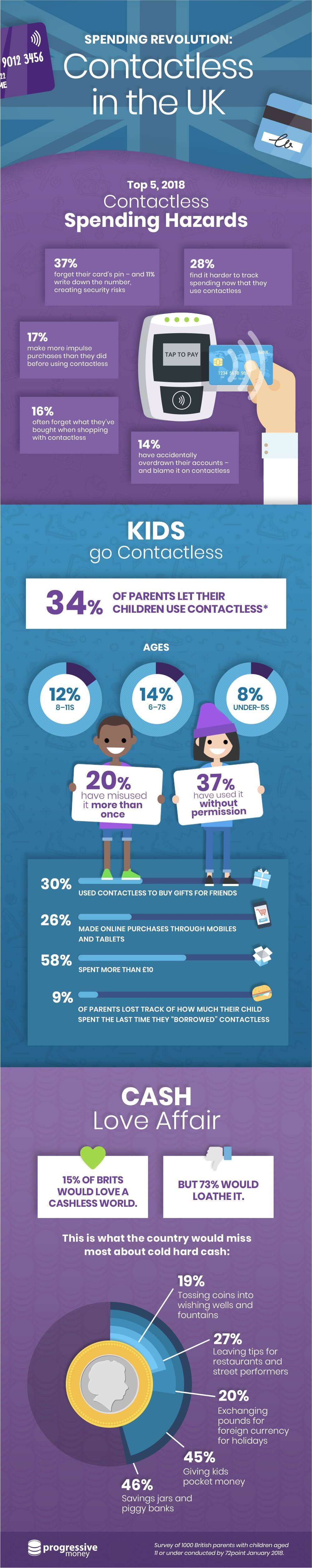

Contactless technology has vastly changed the way we spend. This convenient, simple way to make purchases was introduced a little over 10 years ago – and now, card use as a method of payment is at an all-time high.

As a nation, we’re now making more frequent, smaller card payments than ever before and according to our recent survey, in which we talked to 1,000 parents of under-11s, it’s while in the supermarkets that we’re most tempted to quite literally tap into our money. More than half (61%) told us they’re most likely to use contactless payments while doing their food shop, while – and here’s the real problem – nearly one in five (17%) admit to making more impulsive purchases thanks to the rise of contactless technology. It’s these one-off, little-thought-about purchases that all mount up, and at the end of the month, we’re left wondering where all our money has gone.

So how can we keep an eye on our spending and manage our finances as we hurtle further towards a much-discussed paperless and cashless society? We take a look at some top tips for how you can keep a handle on your finances in this world of so-called frictionless spending.

Bring back the weekly food shop

A simple one, but doing this could help you break down your grocery budget into more manageable chunks and leave you with a better idea of where you stand week in, week out. At the beginning of every month, divide your budget into the number of weeks in the month, and visit the supermarket weekly – and take cash to pay at the checkout. You’re less likely to go into the supermarket throughout the week, and as a result, less likely to spend without thinking.

Carry cash on your person

Of course, you don’t want to make yourself a vulnerable target with a huge wad in your back pocket, but do try to carry small amounts of cash where possible and use this as your ‘pot’ for the next couple of days. Nearly one in five (18%) people don’t carry enough cash on them to make planned purchases, so they rely on contactless – but this only serves to make them more prone to overspending.

Budget for the week

Have a think about what you’re likely to spend over the coming week – then create a budget and stick to it. More than a quarter (28%) of people we spoke to admitted that since using contactless payment methods, they find it much harder to keep track of their spending, while one in 10 (9%) even said they don’t recognise all the charges on their bank statement at the end of the month.

Track your spending

Be it via an app, on your phone’s notepad or simply using a good-old fashioned handwritten list, you can keep abreast of all your outgoings. Thanks to the ease of contactless payments, one in six (16%) people routinely completely forget what they’ve spent on. By listing out all your purchases, you’ll have a much clearer idea of what you’ve spent each month – and how much you have left.

Consider need vs want

We’ve all been there a thousand times: you’re queuing to pay for the essentials and reach the counter, only to be faced with a deluge of tempting offers. You give in because, well, it’s only a quick tap of the card and you’ll not really notice that extra couple of quid. But it’s all these little impulse buys that really add up at the end of the month. Get into the habit of taking a step back and asking yourself whether you really need the item that’s taken your fancy. If not, put it back. You might be surprised at how making better decisions like this will amount to quite a bit extra sitting in your account at the end of the month.

Set a goal

Instil some motivation in yourself by setting a savings goal, whether long-term or short-term. Maybe you’d like to put a deposit down on a house in the near future, or you’re planning to jet off to sunnier climes for your annual holiday? Having your goal at the forefront of your mind will mean you’re more likely to succeed in saving money, or perhaps put more accurately, not impulsively spend on contactless.

Of course, contactless technology makes our lives that little bit easier by enabling quicker, fuss-free payments on purchases. But taking the time to better manage our spending and keeping tabs on those smaller payments is the answer to a healthier bank balance and keeping control of our finances.

Be sure to find out how to manage contactless spending and how to introduce children to contactless shopping with Progressive Money.

Survey of 1000 British parents (with children aged 2 – 11) who use contactless technology provided by 72point in January 2018.

*Of these participants, 34% report that their children do/have used contactless technology. The percentage shown represents the number of responses received.

It’s a monumental time for retail – so monumental in fact, that many are debating whether we’re now starting to see the beginning of the end for cash and physical payments.

In July last year, it was announced that for the first time, the volume of retail purchases made by card accounted for more than half of all customer transactions. It’s little wonder when contactless payment is so simple – effortless even. In fact, contactless transactions now make up around a third of all card purchases.

But it begs the question of whether it’s become too easy to spend money, and in doing so, are we unintentionally passing on bad habits to our children – especially if you take into consideration the results of our survey. We found that more than a third (34%) of parents say their primary and pre-school-aged children have used contactless technology to spend money at some point.

The future of spending

To children, the idea of budgeting is often already an alien concept and if they’re spending money using contactless technology there’s every chance they won’t even consider it ‘real money’. Children of this age are only just being introduced to the world of money and need to be taught about responsible spending. But are we letting standards slip? We surveyed 1,000 contactless-using parents of two-to-eleven year olds, and one in three (34%) told us that their children are also using payment contactless technology. Of these parents, more than a third (37%) admitted their children had used their contactless cards without permission. Further to this, one in five (20%) said that their kids had spent more than they had agreed to the last time they misused a contactless card.

So what do we really need to focus on when it comes to teaching our little ones the value of money in a contactless world? We take a look at the main lessons that will help your children understand money basics.

Contactless is real money

Children learning about money will naturally associate it with coins and notes, so they can’t be expected to fully understand if it’s not a physical entity placed in front of them. Explain to them that there are many ways in which you can pay for things now and physically handing over cash is just one of them. Let them know that contactless spending has repercussions – money is still exchanging hands behind the scenes and the amount you have to spend still goes down.

The importance of permission

Of the parents we surveyed whose children had used their contactless technology without their knowledge, more than half (56%) spent an amount of up to £20 – a relatively large sum if you’re not expecting it to disappear from your account. Explain to your child that using somebody else’s card and money without their permission isn’t acceptable (or legal!) and set and agree boundaries which they can understand. Doing this helps build good money-management skills which your kids can start thinking about now, and long into the future.

The danger of in-app purchases

You might have heard various news stories about kids spending frivolously on in-app purchases, their parents left with little choice but to foot the bill. It’s a very real problem and one that can’t be wished away by parents protesting that they didn’t consent to their child racking up such a hefty amount. Various games on the market include a number of additional items and collectables or a promise to unlock content – but it all comes with a price tag. A couple of years ago, Apple found itself at the center of a deal with the Federal Trade Commission to pay $32.5m to parents whose children made in-app purchases without permission. While it’s been argued back and forth over who should ultimately be held responsible for children spending their parents’ money to keep up with the app, there are things you can do to safeguard bank account. If your child uses your device and they’re old enough to understand, explain a little about the danger of in-app purchases and that they still cost money in the real world. You should also make sure you’re on top of your device’s in-app purchases restrictions and don’t give your children your app store password.

The budget

In today’s age of contactless spending, it’s easier than ever to overspend and completely lose track of what’s going out of your account. No longer is there a need to hand over hard currency – and even the physical interaction with the chip and pin machine is now on the decline. When it comes to yours and your children’s spending, the key is visibility and budgeting. More than a quarter (28%) of parents we spoke to admitted it’s harder to keep track of their spending now they’re using contactless. Be sure to budget at the beginning of every month and keep a keen eye on everything going out of your bank account.

Digital pocket money for kids

Teach your children about contactless spending using real-life methods – and there are a number of apps and initiatives that enable you to do this. For example, you can set up regular pocket money transfers or make one-off payments to your children, or set them activities to encourage them to learn even more. Contactless for kids is the latest must-have banking tool for families and allows for complete control over your children’s spending – all the while allowing them a little freedom and helping them get a better understanding of how money works.

Taking some time to properly explain to your children about money and breaking down the basics of spending in a contactless world can protect your finances and set them up with skills for life.

Contactless tech has revolutionised how we spend money. From creating new spending hazards, to influencing our relationship with cash, here are the latest facts and spending trends emerging this year.

Be sure to find out how to manage contactless spending and how to introduce children to contactless shopping with Progressive Money.

Survey of 1000 British parents (with children aged 2 – 11) who use contactless technology provided by 72point in January 2018.

*Of these participants, 34% report that their children do/have used contactless technology. The percentage shown represents the number of responses received.

Manchester Call Centre

Manchester Call Centre