Ever since the first ancient Assyrian and Babylonian merchants began lending grain to the farmers and traders of the time, human beings have been lending forms of currency to each other for a fee.

The journey the lending industry has undertaken since then has been colourful to say the least. Often maligned in literature through Scrooge type characters, preyed upon by shadowy loan sharks quick to use intimidation as a penalty for late payments, and even getting mentions in the Bible.

As with most industries, however, the complexion of the industry has changed beyond recognition with the onset of technology and robust regulation. Borrowing has not gone away, and the basic transaction remains the same with one party providing capital for another, for it to be paid back with interest. How borrowers acquire capital, how they pay it back, and their reasons for needing it though, have all changed dramatically.

Why we borrow

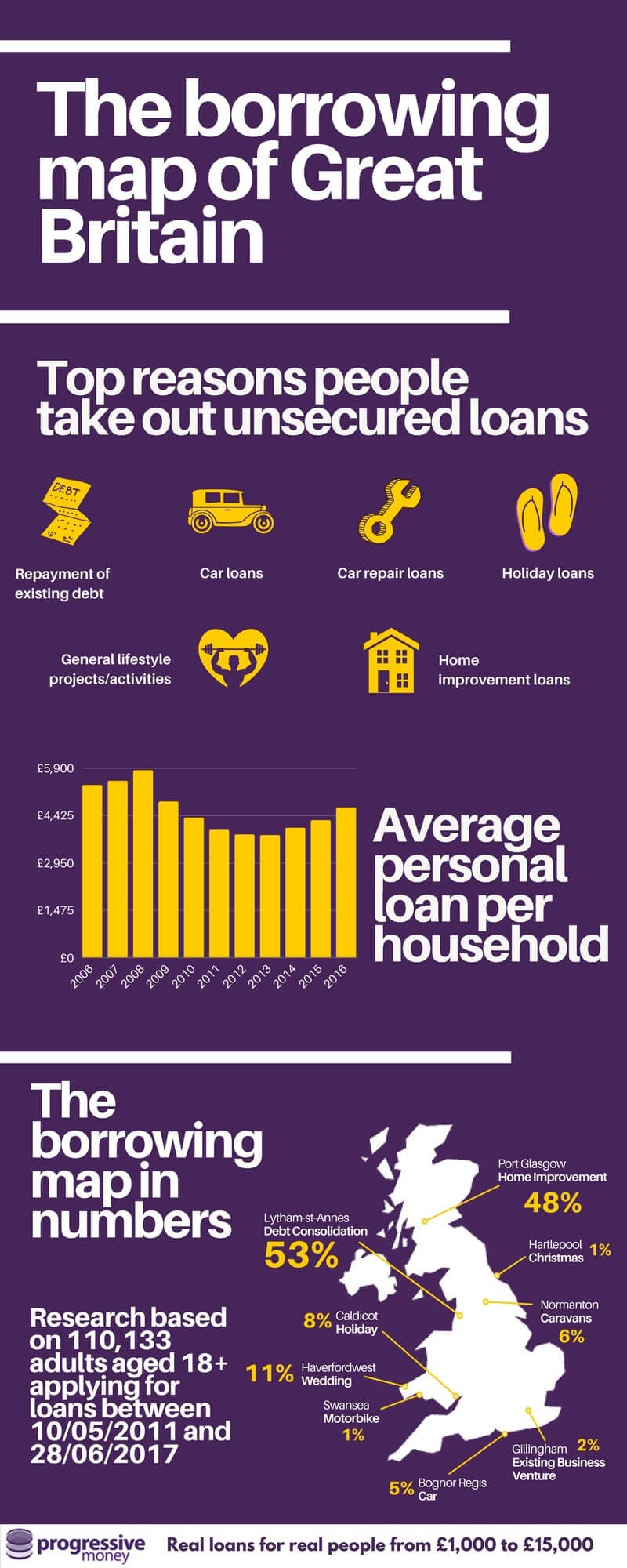

In the past, loans were taken primarily as a means of survival, be it for land, livestock, even simply for food. As civilisation has evolved, so have our needs for emergency capital. Perhaps the most interesting development has been the loan to pay off debt. Outstanding liabilities would once have precluded a person from qualifying for a loan. Today the flagship product of many companies is one which consolidates all owed monies into one payment, usually to be returned in monthly instalments. Illustrating this trend well, Darwin Group, which incorporates Progressive Money, recently undertook a survey of over 110,000 people from across the UK. In Lytham St Annes, over half (53%) of respondents cited debt consolidation as their reason for taking out an additional loan.

The technology we depend on also features high amongst the reasons people go to official third parties for capital. Cars and computers are now commodities few can function without and they often need replacing and repairing. Unfortunately, these commodities rarely give warnings when they need to be replaced or repaired, and the cost of both can be high -necessitating the need for a loan.

Perhaps a cheerier trend which has developed has been that of people taking out loans not so much out of desperation, but to finance more exuberant purchases. Amongst the top reasons people now borrow, is to finance holidays and an array of general lifestyle pursuits and projects. Linked to this are monies borrowed to make home improvements. Indeed, the Darwin survey discovered that 48% of those questioned in Port Glasgow, had taken out loans to spruce up their homesteads.

Beyond these, paying for Christmas and caravans all featured as reasons Darwin Group found for people turning to loans, with 11% of smitten folk from Haverfordwest borrowing to pay for their weddings.

How much are we borrowing?

The average household loan was increasing steadily from the turn of the millennium before topping at almost £6,000 in 2008. In 2009 that figure fell sharply to around £5,000. Few people will need reminding what happened around that time. The ‘credit crunch’ as it became widely referred to, saw a contraction in spending for most people and most industries. The reason for the dip in borrowing was most likely two-fold, with people unwilling to take on more debt in an uncertain economic climate, and loan companies reluctant to lend money, similarly fearing the country’s financial predicament. The value of household loans continued to drop before plateauing in 2012/13 at around £4,000. Since then, there has been a gradual increase, and the average loan now stands at comfortably over £4,500.

Where do we turn when the bank says no?

The ‘computer says no’ phenomenon is all too familiar for people trying to acquire capital when their credit scores are not the best. Fortunately, there are other options. Progressive Money, a subsidiary of Darwin Group, offer a degree of flexibility that rival companies struggle to match. Offering unsecured loans of up to £15,000, over terms of up to ten years, they accept customers with recent defaults or CCJs, who’ve missed mortgage payments within the last 12 months, and will lend to benefits claimants and the retired, typically transferring funds within three days. Progressive by name, progressive by nature.

Manchester Call Centre

Manchester Call Centre